Wealth Management Module (Intermediate)

NCFM offers a Wealth Management Module to provide comprehensive and in-depth knowledge about wealth management. Using the Wealth Management Module, you will be to:

- Firstly, get comprehensive and broad-based knowledge about wealth management.

- Secondly, understand the role of various investment products and structured products in long term wealth creation as well as the risks underlying such products and services.

- Lastly, understand the assessment of the risk profile of clients and the importance of asset allocation in wealth management.

Target Audience:

The best suitable audience for the Wealth Management Module course include:

- Firstly, Students

- Secondly, Investors

- Thirdly, Finance Professionals

- Lastly, anybody having an interest in this area

Wealth Management Module (Intermediate) Interview Questions

Exam Details

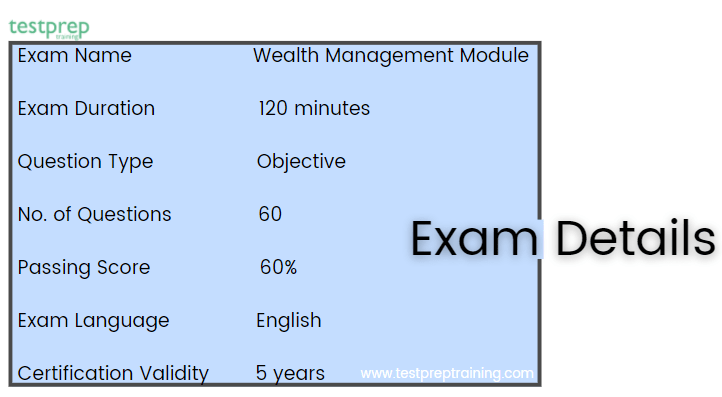

You must be aware that the NCFM examinations are online, self-study tests that are held all throughout India. The examinations are conducted in English. However, an Open Office Spreadsheet will be given for the Wealth Management Module, and there will be 0.25 percent negative marking for wrong responses. Additionally, all sorts of calculators are permitted throughout the exam.

- Firstly, there will be a total of 60 questions in the exam that has to be answered in a time duration of 120 minutes.

- Secondly, to pass the exam it is necessary to score 60%. And, in the exam, there will be objective type questions only. That is, for every question, you will find four / five alternative answers. And, to select your answer, just click on the radio button next to the alternative.

- Lastly, the exam will cost you Rs.2006/ inclusive of GST. And, the certification is valid for 5 years.

Exam Registration

Candidates can register for the exam online by going to Education, then clicking Certifications, and then Online Register / Enroll. You will receive a unique NCFM registration number, as well as a user id and password, after completing the registration process. The confirmation, on the other hand, will be sent to the email address and cellphone number provided during registration. Then, using the same method, you may access your:

- Firstly, an online NCFM account to make payment

- Secondly, enroll for the test

- Thirdly, update the address

- Lastly, check study material status or viewing certificates

However, candidates are required to ensure that their latest address is updated in their online NCFM profile. In order to update addresses candidates need to access the link ‘Edit Profile’ available in their NCFM online login. And, candidates should note that the NCFM registration number is unique and a candidate has to use the same NCFM registration number while enrolling for any module.

NCFM Wealth Management Course Structure

NCFM provides a course outline for the Wealth Management Module which will help you to understand the concepts in a sequential manner. These are divided into sections. They are:

1. Introduction to Financial Planning

- Background

- Role of Financial Planner

- Financial Planning Process

- Contract and Documentation

- Client Data Collection

- Client Data Analysis

- Life Cycle

- Wealth Cycle

- Risk Profiling and Asset Allocation

- Systematic Approach to Investing

- Systematic Investment Plan (SIP)

- Then, a Systematic Withdrawal Plan (SWP)

- Systematic Transfer Plan (STP)

- Financial Plan

- Goal-based Financial Plan

- Comprehensive Financial Plan

- Financial Blood-Test Report (FBR)

- Financial Planning in India

2. Wealth Management & The Economy

- Financial Planning to Wealth Management

- Economic Cycles and Indicators

- Lag Indicators

- Co-incident Indicators

- Lead Indicators

- Interest Rate Views

- Currency Exchange Rate

- The Deficits

- Revenue Deficit and Fiscal

- Current Account Deficit

3. Investment & Risk Management: Equity

- Role of Equity

- Active and Passive Exposures

- Returns from Passive Exposure to S&P CNX Nifty

- Sector Exposure and Diversification

- Fundamental and Technical Analysis

- FundamentalValuationApproaches

- Investment and Speculation

- Leveraging

4. Investment & Risk Management: Debt

- Role of Debt

- Deposits and Debt Securities

- Valuation of Debt Securities

- Yields and Interest Rate Risk

- Interest Rate and Debt Investments

- Credit Exposure and Debt Investments

- Concentration Risk

- Passive Investments in Debt

5. Investment & Risk Management: Alternate Assets

- Gold

- Role of Gold

- Gold Investment Routes

- Rupee returns from Gold

- Real Estate

- Role of Real Estate

- Real Estate Investment Routes

- Real Estate Indices

6. Investment Product & Services

- Derivatives

- Futures

- Options

- Mutual Fund

- Venture Capital / Private Equity Funds

- Hedge Funds

- Structured products

- Portfolio Management Services (PMS)

7. Investment Evaluation Framework

- Risk-ReturnFramework

- Risk

- StandardDeviation

- Beta

- Risk-Adjusted Returns

- Sharpe Ratio

- Treynor Ratio

- Alpha

- SSELECTIVVELLY-Invest Classification Scheme for Investment Products

8. Risk Profiling & Asset Allocation

- Risk Profiling

- Why Asset Allocation?

- Strategic Asset Allocation

- Tactical Asset Allocation

- Fixed Asset Allocation

- Flexible Asset Allocation

- Asset Allocation Returns in Debt and Equity

- Fixed Asset Allocation with Annual Rebalancing

- Flexible Asset Allocation

- Asset Allocation Returns in Equity, Gold and Debt

- Fixed Asset Allocation with Annual Rebalancing

- Flexible Asset Allocation

- Allocation to Speculation

- Diversification in Perspective

9. Risk Management through Insurance

- Risk Assessment

- Life Insurance

- Health Insurance

- General Insurance

- Safeguards in Insurance

10. Elements of Taxation

- Previous Year and Assessment Year

- Gross Total Income

- Income Tax Slabs

- Advance Tax

- Tax Deducted at Source (TDS)

- Exempted Income

- Deductions from Income

- Section 80C

- Then, Section 80CCC

- Section 80CCD

- After that, Section 80D

- Section 80E

- Section 80GG

- Long Term and Short Term Capital Gain / Loss

- Speculation Profit / Loss

- Capital Gains Tax exemption under Section 54EC

- Capital Gains Tax exemption under Section 54F

- Setting Off & Carry Forward

11. Taxation of Investment Products

- Dividend Tax / Tax on Income Distributed by Mutual Fund

- Securities Transaction Tax (STT)

- Capital Gains Taxation

- Taxation of Fixed Maturity Plans and Fixed Deposits

- Fixed Deposits

- Fixed Maturity Plans (FMP)

- Growth Options and Dividend in Mutual Fund schemes.

- Wealth Tax.

12. Estate Planning

- Background

- Assets & Liabilities

- Nomination

- Inheritance Law

- Will

- Trust

Wealth Management (Intermediate) Module FAQs

For More: Check Wealth Management Module FAQs

NCFM Procedures

NCFM provides various procedures for the exam to help candidates to easily navigate through the sections. Some of them include:

1. Taking the Test

- Firstly, candidates need to take the test at the designated NSE test center selected at the time of enrollment.

- Secondly, candidates need to be present at the test center 30 minutes prior to the test time. And, those reaching late will not be allowed to take the test. In such cases, the candidate would need to take the enrollment again.

- Thirdly, candidates need to carry an original Photo ID proof of verification. Valid photo ID proof includes PAN card, Driver’s License, Passport, Employee ID, Voter’s ID card, or Student ID card issued by college or school.

- Next, the candidate may bring a scientific calculator and a pen to the test venue. However, a backup sheet and rough sheet(s) would be provided to the candidates during the test.

2. Certificate

- NSE states that certificates for all modules will be given to the successful candidates at the test center itself. However, failed candidates will be provided with a scorecard at the test center. Candidates are encouraged to gather their materials before leaving the testing site. Successful applicants can also access their certificates online using the ‘Query/Report’ option in their NCFM online login.

NCFM Wealth Management Module Study Guide

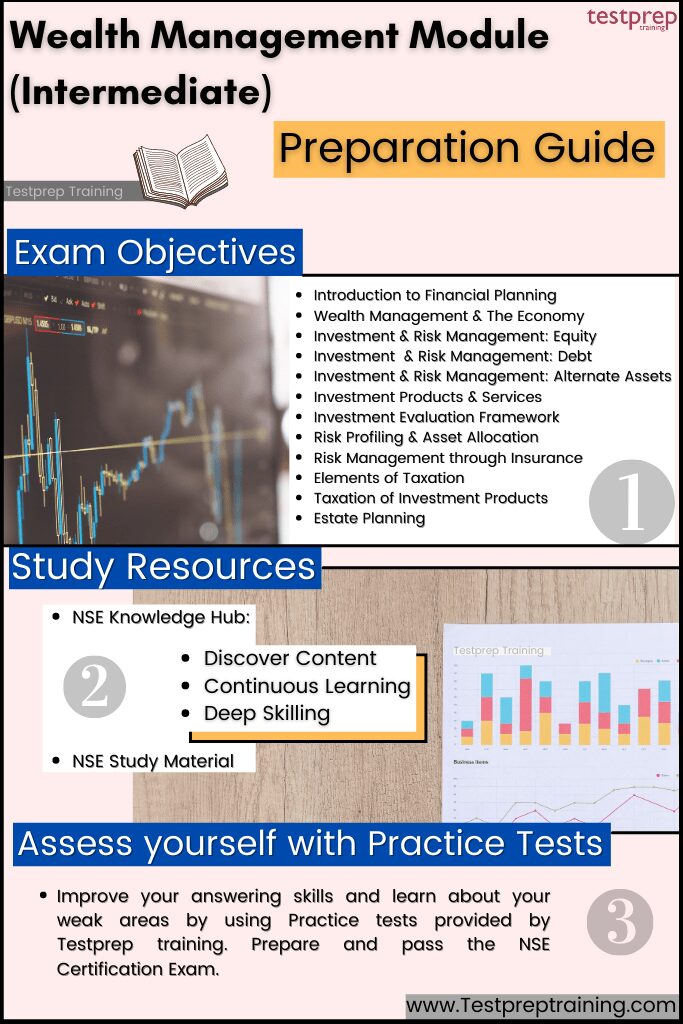

1. Exam Objectives

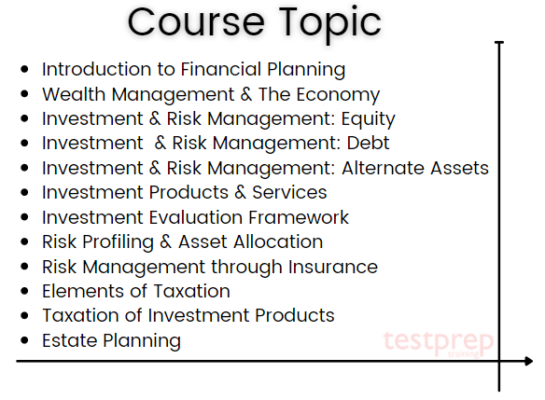

NCFM provides course outline for the Wealth Management Modules. This outline consists of topics that are divided into sections and subsections. However, using this will help you start preparing topic wise in a sequential. For Wealth Management Module, the course topics include:

- Firstly, Introduction to Financial Planning

- Secondly, Wealth Management & The Economy

- Thirdly, Investment & Risk Management: Equity

- Then, Investment & Risk Management: Debt

- Investment & Risk Management: Alternate Assets

- After that, Investment Products & Services

- Investment Evaluation Framework

- After that, Risk Profiling & Asset Allocation

- Risk Management through Insurance

- Then, Elements of Taxation

- Taxation of Investment Products

- Lastly, Estate Planning

2. NSE Knowledge Hub

NSE offers an AI-First and Mobile-First ecosystem of personalized and community-based learning. This knowledge hub is a unique Artificial Intelligence (AI) powered learning platform designed for financial learning and to assist the BFSI sector in enhancing skills for their employees and helping academic institutions in preparing future-ready talent for the financial services industry. NSE Knowledge Hub will help in:

- Firstly, becoming a part of a growing learning community.

- Secondly, providing access to unlimited content from global and premium resources.

- Thirdly, learning from experts who are leaders in their field.

- Lastly, learning on the go through mobile.

Further, it includes methods like:

- Discovering Content

- This knowledge hub helps you to become familiar with banking, insurance and finance topics. And, discover content in various domains in finance

- Continuous learning

- This hub provides Formal and informal learning through of hours of arranged content tailored to the individuals areas of interests and goals

- Deep skilling

- This up-Skill by enrolling in free or paid deep skilling pathways at a marketplace with well-known providers of courses, assessments, labs and credentials.

3. NSE Wealth Management Study Material

NSE provides a workbook that shall be issued only after making payment for the module. And, then you can download the study material after logging into your account from the E-Library option. Candidates who wish to acquire NCFM module workbooks should send a request letter along with a demand draught for Rs. 500/- per module per workbook. However, the request letter should clearly include the candidate’s name, the module’s name, the candidate’s entire postal address, contact information, and the demand draught details.

4. Take Practice Tests

NCFM Wealth Management Module Practice Tests are a good way to prepare for the test. This will not only assist you in improving your replying abilities, but it will also allow you to identify your weak areas. NCFM Wealth Management Module Sample Questions will improve your understanding of the subjects in this module as well as provide a solid review. What’s more crucial, though, is to obtain the one-of-a-kind sample practice exams. So, begin your study and obtain the greatest NCFM Wealth Management Module Practice Exams accessible in order to pass the exam with a high grade.