NISM Series-V-C: Mutual Fund Distributors (Level 2)

The NISM Series-V-C: Mutual Fund Distributors (Level 2) examination seeks to create a common knowledge benchmark for associated persons, i.e., distributors, agents, or any persons employed or engaged in the sale and distribution of mutual fund products and advisory functions. This certification would enable a better understanding of features of advanced mutual fund products, fund valuation, fund performance measurements, investor service, and related regulations.

Target Audience

- Mutual fund distributors and agents

- Persons employed or engaged in the sale and/or distribution of mutual fund products

- Persons to be employed or engaged in the sale and/or distribution of mutual fund products

- Students interested in gaining advanced knowledge of mutual fund products, sales, distribution, and related regulations

Exam Details

Understanding the exam details is a very crucial step and should not be skipped. It gives you an idea about the exam format and helps you prepare a suitable study plan. Additionally, it also helps you build your speed and accuracy. This certification is the roadmap towards a successful and thriving career but before that let’s understand the exam details.

The Mutual Fund Distributors examination consists of 8 caselets with 4 multiple-choice questions of 2 marks each per caselet and 36 one-mark multiple-choice questions adding up to 100 marks. The examination should be completed in 120 minutes. There is a negative marking of 25% of the marks assigned to a question. The minimum passing score for the examination is 60 marks. The certification will be valid for a period of 3 years and its cost is Rs. 1770

Eligibility Criterion

There is no eligibility criterion to take this exam

| Exam Name | NISM Series-V-C: Mutual Fund Distributors (Level 2) |

| Exam Duration | 120 minutes |

| No. of Questions | 68 |

| Maximum marks | 100 |

| Passing Marks | 60% and above |

| Cost | Rs. 1770 |

| Validity | 3 Years |

Scheduling the Exam

Now, let us understand how to register for the NISM Series-III-A exam.

Registration process

- To register and enroll for NISM Certification Examination and CPE Program, the candidate needs to fill in the Online Registration Form available on the NISM Online Certification System at https://certifications.nism.ac.in

- Activate your NISM account by clicking on the link sent at the registered email ID

- Login into NISM Certification Portal using your registered email ID and password.

- Then click on New Enrollment for NISMCertificationExamination to enroll for the NISMCertification Examination

- Now, select Date & TestCentreSelect SlotMake Online PaymentCredit/ Debit Card, NetBanking

NISM Series-V-C: Mutual Fund Distributors (Level 2) FAQs

Get all your doubts and queries resolved with NISM Series-V-C: Mutual Fund Distributors (Level 2) FAQs

NISM Series-V-C: Mutual Fund Distributors (Level 2) Course Outline

The Mutual Fund Distributors (Level 2) Course Outline is as follows:

Unit 1: Mutual Fund structures

1.1 Know the structure and working of funds such as:

1.1.1 Fund of funds

1.1.2 Exchange Traded Funds

1.1.3 REMF and REIT

1.1.4 Venture Capital Funds

1.1.5 Angel Funds

1.1.6 Private Equity Funds

1.1.7 International funds

Unit 2: Legal and Regulatory Environment of Mutual Funds

2.1 Understand the investment norms for mutual funds

2.2 Know the regulatory framework for REMF and REIT

2.3 Explain SEBI norms for mutual funds’ investment in derivatives

2.4 Describe SEBI norms with respect to change in controlling interest of an AMC

2.5 Discuss the process for making changes to the mutual fund’s fundamental attributes, consolidation of schemes, etc.

Unit 3: Fund Distribution and Sales Practices

3.1 Understand the working of newer channels of MF distribution such as internet and mobile technologies

3.2 Understand mutual fund transactions through stock exchanges mechanism

Unit 4: Investment and Risk Management

4.1 Differentiate between Fundamental Analysis and Technical Analysis and understand how these are applied in investment management

4.2 Detail the basics of Quantitative Analysis in investment decision making

4.3 Understand key concepts pertaining to the management of debt investments

4.4 Understand and analyse the basics of managing exposure to markets through derivatives such as Forwards, Futures, Options and Swaps

4.5 Discuss how derivatives can be used for the purpose of portfolio rebalancing and replicating an index

Unit 5: Valuation of Schemes

5.1 Understand and analyse how investments are valued in schemes

5.1.1 Equities

5.1.2 Debt

5.1.3 Gold

5.1.4 Real Estate

5.1.5 NPA Provisioning

Unit 6: Accounting

6.1 Understand how the net asset value (NAV) of a scheme is calculated and the various accounting requirements that have a bearing on NAV

6.2 Discusses how unit-holder’s transactions are accounted in the scheme

6.3 Know the concept of distributable reserves

6.4 Know the unique aspects of accounting related to real estate mutual fund schemes

Unit 7: Taxation

7.1 Analyse the impact of various tax provisions on mutual funds and investors in mutual fund schemes

7.1.1 Dividend Distribution Tax

7.1.2 Taxability of dividends and capital gains

7.1.3 Securities Transactions Tax

7.1.4 Setting off gains and losses and carry forward of losses under Income Tax Act

7.1.5 Dividend stripping and Bonus stripping

Unit 8: Investor Services

8.1 Describe the processes underlying investment in new fund offers, open end funds, closed end funds and ETFs

8.2 Briefly outline the concepts of nomination and pledge

Unit 9: Scheme Evaluation

9.1 Calculate return on investment

9.1.1 Simple, annualized, compounded returns, CAGR and XIRR

9.1.2 Applicability of different returns to evaluate different types of funds

9.2 Understand risks in fund Investing: Standard Deviation and Beta

9.3 Understand Benchmarks and their role in scheme evaluation

9.4 Analyse the fund managers’ performance using Sharpe Ratio, Sortino Ratio, Treynor Ratio, Jensen’s Alpha, Appraisal Ratio, Eugene Fama and M2

9.5 Understand the limitations of quantitative evaluation

Unit 10: Asset Classes and Alternate Investment Products

10.1 Know historical perspective on Returns and Risk in Equity, Debt and Gold

10.2 Discuss a few alternative investment products available to the investors such as:

10.2.1 Capital protection oriented schemes

10.2.2 Structured products and equity linked debentures

10.3 Know basic details about portfolio management services and hedge funds

Unit 11: Cases in Financial Planning

11.1 Discuss practical aspects of financial planning including risk profiling, cashflow planning, asset allocation, suggesting investment products and mutual fund schemes to investors and helping investors build their portfolio

Unit 12: Ethics and Investor Protection

12.1 Discuss various forms of mis-selling of mutual funds and Systemic safeguards for their prevention

12.2 Know the safeguards provided by the structure of mutual funds

12.3 Know the steps taken by the regulator to protect mutual fund investors against frauds

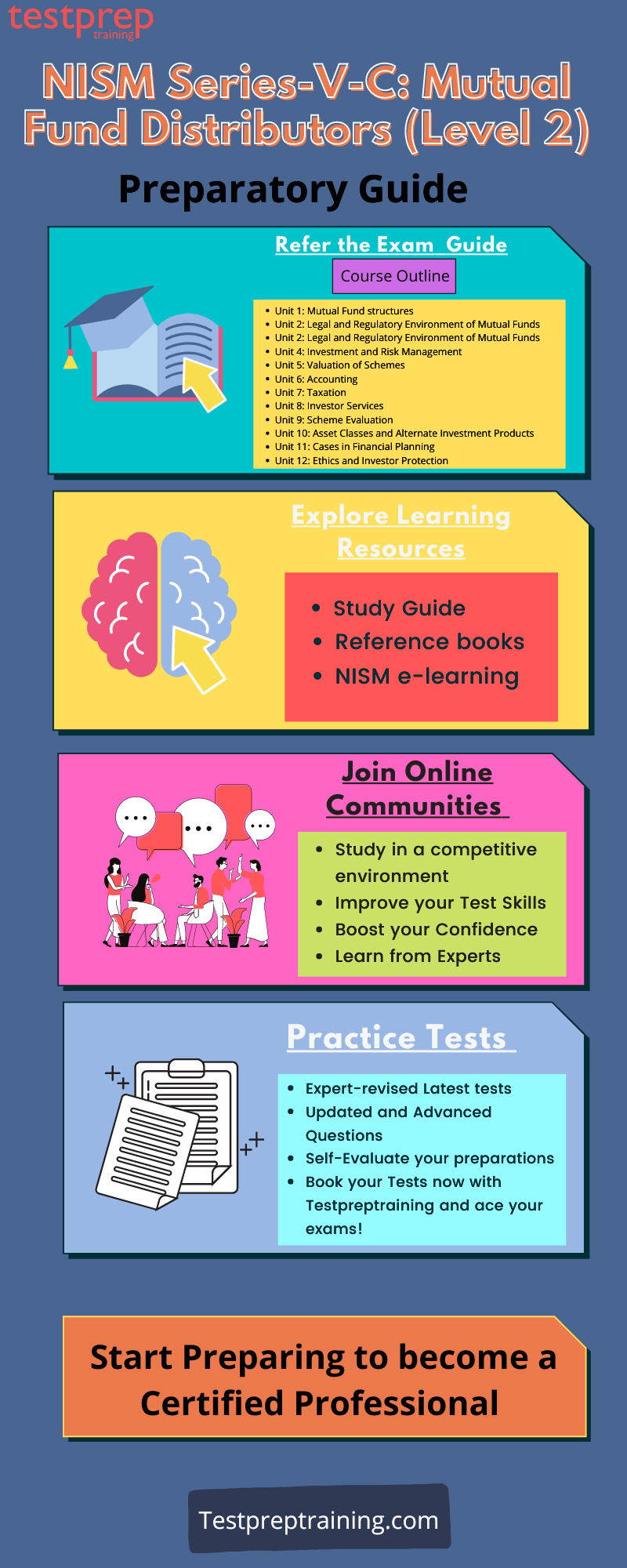

NISM Series-V-C: Mutual Fund Distributors (Level 2) Preparatory Guide

Now, that we have read about the NISM Series-V-C: Mutual Fund Distributors (Level 2) exam and its details, the next important step is to understand how to prepare for the exam. Preparing for any exam is not an easy task and cannot be done with the blink of an eye. It requires a lot of dedication and hard work combined with the right set of resources to ace the exam. There are numerous resources available online but we need to figure out the ones that are beneficial for us. The NISM Series-V-C: Mutual Fund Distributors (Level 2) exam is a step towards a bright and successful career. To clear this exam you need an intent eagerness to learn. Our Preparatory Guide here will help you all along your journey and prepare you well for the exam.

Step-1 Review the Exam Objectives

Reviewing the exam objectives is an important step to ensure that nothing is left out. As mentioned earlier, going through the course outline is really important while preparing for any exam to make sure everything is covered. Furthermore, Familiarising yourself with the exam objectives helps is grasping concepts faster and with accuracy. NISM Series-V-C: Mutual Fund Distributors (Level 2) exam comprises of 12 units namely-

- Unit 1: Mutual Fund structures

- Unit 2: Legal and Regulatory Environment of Mutual Funds

- Unit 2: Legal and Regulatory Environment of Mutual Funds

- Unit 4: Investment and Risk Management

- Unit 5: Valuation of Schemes

- Unit 6: Accounting

- Unit 7: Taxation

- Unit 8: Investor Services

- Unit 9: Scheme Evaluation

- Unit 10: Asset Classes and Alternate Investment Products

- Unit 11: Cases in Financial Planning

- Unit 12: Ethics and Investor Protection

Step-2 Discover your Learning Resources

NISM Series-V-C: Mutual Fund Distributors (Level 2) Study Guide

The NISM Series-V-C: Mutual Fund Distributors (Level 2) Study Guide will provide you complete clarity about the exam questions and how to approach them while preparing you from the scratch.

Reference Books

Books are your best friends which provides you with new insights that the study guides may not, giving you an extra edge over others. You can choose any book that suits your way of preparation. However, Make sure the content is understandable and the book offers you a lot of practice questions and has previous test papers. You can choose multiple books and can buy them or can refer to libraries, however, you should always look for books written by credible and authentic domain experts.

NISM e-learning

NISM eLearning offers learners exposure to high quality content, personalized self-paced learning experience that can be accessed anytime from anywhere. It is a rich and rigorous platform that offers a consistent, cohesive, and quality learning experience for learners. The Course content is delivered exclusively via our Learning Management System (LMS). Furthermore, learners will also be able to form meaningful connections with peers and educators which would give them an extra edge over others in their preparation.

Step-3 Join Online Communities

Joining an Online Community is certainly an ideal way to know your actual stand in the competition. Here, you can interact with your competitors, and keep yourself focused. Also, multiple viewpoints make the stuff more dynamic and expand your domain. Moreover, these groups will help you stay up to date with the exam and will also boost your confidence and self-esteem.

Step-4 Practice tests

Once you are done with your preparation phase, your performance phase begins. This phase is also referred to as the self-evaluation phase as it helps you find out your core strengths and weak spots and help you prepare better. They also help you build confidence and learn time management. Moreover, Practice tests are designed in such a manner that it helps the candidates to encounter the real exam environment around them and also give them an idea about what type of questions will be expected in the actual exam. Take the NISM Series-V-C: Mutual Fund Distributors (Level 2) Practice Test Now!