NCFM Mutual Funds: A Beginner’s Module

Mutual funds have become a much sought-after investment product in recent years. NSE Mutual Funds: A Beginner’s Module exam demystifies the concept of mutual funds and helps create awareness and knowledge about the industry and its functioning.

Target Audience

The exam is targeted towards the following mentioned audience:

- Firstly, students

- Secondly, investors

- Thirdly, financial planners

- Fourthly, analysts

- Also, equity researchers

- Lastly, anybody having an interest in the Indian mutual fund industry

Mutual Funds Exam Details

Before you begin your preparations, you should familiarise yourself with the exam specifics. The Mutual Funds: A Beginners Module Exam Questions are in Multiple Choice Format. You get 120 minutes to complete the 60 questions of this exam. Also, the exam is valid for 5 years. Moreover, Mutual Funds: A Beginners Module Questions are available in English language only. Further, the passing score is 50%.

| Exam Name | Mutual Funds: A Beginner’s Module |

| Exam Vendor | NSE – National Stock Exchange of India Ltd. |

| Exam Level | Foundation |

| Certification Validity | 5 Years |

| Exam Language | English |

| Exam Format | Multiple Choice Questions |

| Exam Duration | 120 minutes |

| Number of Questions | 60 |

| Passing Score | 50% |

| Negative Marking | Yes |

Exam Registration

Candidates can register online by accessing the link ‘Online Registration’ available under Education>Certifications>Online Register / Enroll.

Once registered, you will get a unique NCFM registration number along with a user id and password. Confirmation will be sent to the email id and mobile number entered during registration. Using the same, you can access your online NCFM account to make payment / enroll for test/update address/check study material status/view certificates, etc.

Frequently Asked Questions

CLICK HERE to move to the Frequently Asked Questions section.

Course Outline

The Mutual Funds: A Beginners Module Course Outline provides descriptive details about the exam domains:

Mutual Funds

- Concept and structure of mutual funds in India

- Role of custodian

- Also, Registrar and transfer agent

- AMC

- New fund offer’s & procedure for investing in NFO

- Lastly, Investors rights and obligations

Mutual Fund Products and Features

- Concept of an open-ended and close-ended fund

- Types of funds – equity, index, diversified large-cap funds, midcap fund, sec or fund, and other equity schemes

- Concept of entry and exit load Expense ratio

- Also, Portfolio turnover

- AUM

- Lastly, Analysis of cash level in portfolio

Gold ETF’s

- Introduction of exchange-traded funds, Market making by authorized Participants

- Creation Units

- Also, Portfolio deposits and cash Component

Debt Funds

- Salient features of debt fund

- Concept of interest rate and credit risk

- Also, Pricing of the debt instrument.

Liquid Funds

- Salient features of liquid fund

- Floating rate scheme and portfolio churning in liquid funds

Taxation

- Taxation of capital gains

- Indexation benefit and FMP

Regulation

- Role and objectives of AMFI

- Also, Different types of plans

- Systematic Investment Plan (SIP)

- Systematic Transfer Plan (STP) and Systematic Withdrawal Plan (SWP)

- Lastly, Dividend payout.

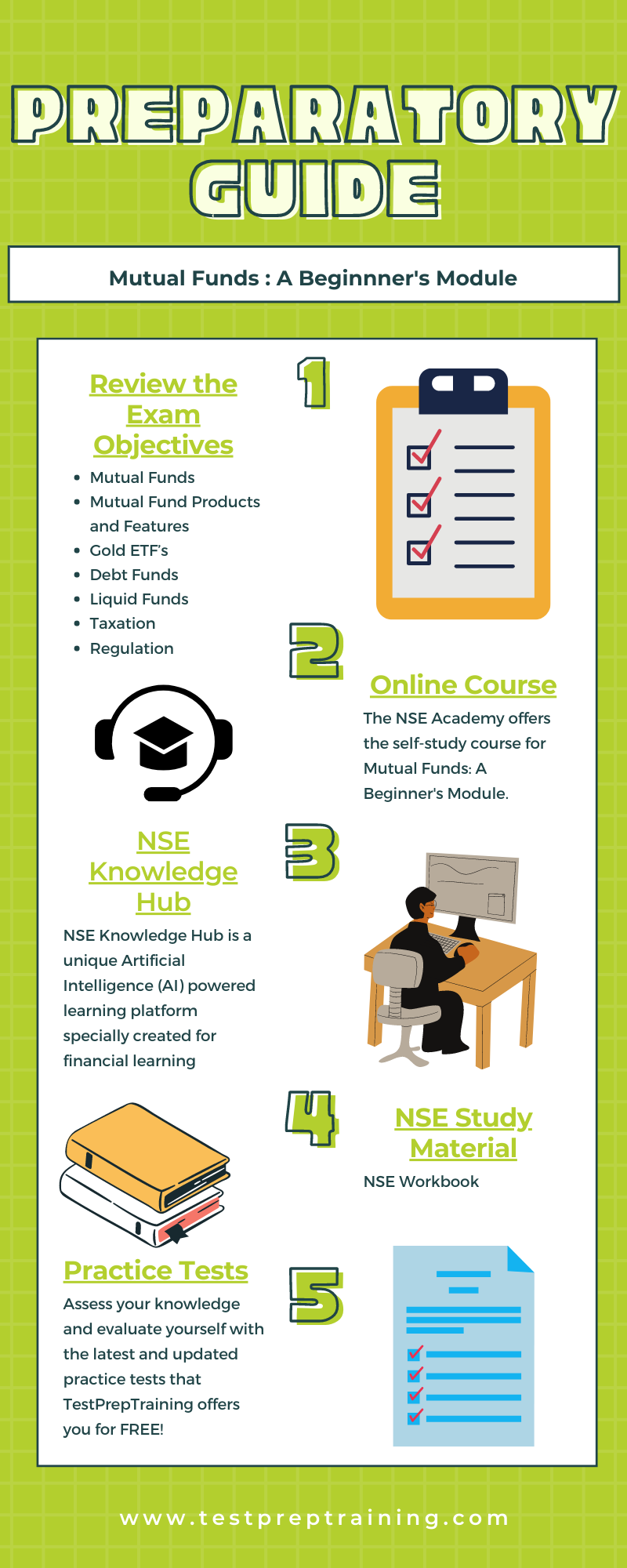

Preparatory Guide – Mutual Funds

Before you get started, you must refer to the following Mutual Funds: A Beginners Module Study Guide that mentions all the relevant and possible learning resources that are ideally required for the exam preparation.

Refer to Exam Objectives

For Mutual Funds: A Beginner’s Module, NCFM provides the course outline. This course outline includes topics categorized into various sections and subsections, thus, helping candidates to start their preparation in a sequential way. For the test, the course outline includes:

- Firstly, Mutual Funds

- Secondly, Mutual Fund Products and Features

- Thirdly, Gold ETF’s

- Fourthly, Debt Funds

- Also, Liquid Funds

- Furthermore, Taxation

- Lastly. Regulation

Online Course

The NSE Academy offers the self-study course for Mutual Funds: A Beginner’s Module. Enrolling in here can help you understand all the fundamentals and essential concepts. Furthermore, this will lead to help you prepare for the test.

NSE Knowledge Hub

NSE Knowledge Hub is an AI-First and Mobile-First ecosystem of personalized and community-based learning. This is a unique Artificial Intelligence (AI) powered learning platform specially created for financial learning and to assist the BFSI sector in enhancing skills for their employees and helping academic institutions in preparing future-ready talent skilled for the financial services industry.

- Firstly, become familiar with banking, insurance, and finance topics, discover content in various domains in finance

- Secondly, formal and informal learning through hours of curated content tailored to the individual’s areas of interests and goals

- Lastly, Up-Skill by enrolling in free or paid deep skilling pathways at a marketplace with well-known providers of courses, assessments, labs, and credentials

Mutual Funds: A Beginners Module Study Material

NSE provides a workbook for its all certification exam that can be issued only after making payment for the module. This can be easily downloaded by logging into your account from the E-Library option. However, NSE also offers candidates to purchase the Workbooks for NCFM modules by sending a request letter. This has to be done along with a demand draft of Rs. 500/- per module per workbook.

Practice Tests

Self-evaluation provides you with greater insight into your preparation. Before the actual certification test, indeed, it is highly recommended to give practice tests. Moreover, these Mutual Funds: A Beginners Module Sample Questions will help you determine your skills and preparation, making you familiar with the exam pattern.

Assess your knowledge and evaluate yourself with the latest and updated Mutual Funds: A Beginners Module Practice Tests that TestPrepTraining offers you for FREE!