Banking Sector Module (Intermediate)

Businesses need funds for establishment, growth, and development. Banks remain the main pillar for financing business activities. There is an increased need for qualified individuals who possess requisite skills and significant knowledge in banking in these fast-moving, globalized financial markets. The Banking Sector Module (Intermediate) exam is formulated by the NSE. The exam covers the modules which aim at providing a basic insight about banking operations and acquaint the learners with various banking-related services.

Who should take the exam?

- Students of Management and Commerce

- Finance Professionals

- Employees with banks and financial institutions

- Distributors / Agents

- Anybody having interest in this subject

Exam Details

The applicant should familiarise themselves with the test specifics before commencing their preparations. The exam questions for the Banking Sector Module (Intermediate) are in multiple-choice format. The candidate has 120 minutes to finish the exam’s 60 questions. The test is also valid for five years. Furthermore, the Banking Sector Module (Intermediate) Questions are only available in English. Furthermore, a 60% pass rate is required.

| Exam Name | Banking Sector Module |

| Exam Vendor | NSE – National Stock Exchange of India Ltd. |

| Exam Level | Intermediate |

| Certification Validity | 5 Years |

| Exam Language | English |

| Exam Format | Multiple Choice Questions |

| Exam Duration | 120 minutes |

| Number of Questions | 60 |

| Passing Score | 60% |

| Negative Marking | Yes |

Exam Registration

Candidates can register online by accessing the link ‘Online Registration’ available under Education>Certifications>Online Register / Enroll.

The candidate will get a unique NCFM registration number, as well as a user id and password, after registering. The email address and cellphone number provided upon registration will get confirmation. They may use the same to access their online NCFM account to make payments, enrol for tests, amend addresses, check the status of study materials, and see certificates, among other things.

Banking Sector Module (Intermediate) FAQ

Banking Sector Module (Intermediate) Course Outline

The next most critical step is to comprehend the course outline. It acquaints the candidate with the exam’s format and goals. The test outline for the Banking Sector Module (Intermediate) comprises domains and subtopics that give further information about the course.

Introduction to Banking

- Fundamental role and evolution

- Banking structure in India

- Licensing of banks in India

- Branch licensing

- Foreign Banks

- Private Banks – Capital and voting rights

- Dividend

- Corporate Governance

Banking and the Economy

- Cash Reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

- Repo and Reverse Repo

- Open Market Operations

- Security Valuation

- Capital Account Convertibility

Bank Deposits, Nomination and Deposit Insurance

- Kinds of deposits

- Joint accounts

- Nomination

- Closure of deposit accounts

- Deposit insurance.

Other Banking services

- Fund-based services.

- Non-Fund based services

- Money Remittance Services

- Banking Channels.

Bank – Customer Relationship

- Roles of Banks.

- Bankers’ obligation of secrecy

Security Creation

- Pledge

- Hypothecation

- Mortgage

- Assignment

NPA and curitisation

- Non-Performing Assets

- NPA categories

- NPA Provisioning Norms

- SARFAESI Act.

Understanding a Bank’s Financials.

- Balance Sheet

- Profit & Loss Account

- Camels Framework

Basel Framework.

- Bank for International Settlements (BIS)

- Basel Accords

Regulatory Framework (Part 1)

- Anti-Money Laundering and Know Your Customer

- Banking Ombudsman Scheme, 2006

Regulatory Framework (Part 2)

- Indian Contract Act, 1872

- Sales of Goods Act, 1930

- Negotiable Instruments Act, 1881

- The Limitation Act, 1963

Financial Inclusion

Test Taking Procedure

- Firstly, there are designated NSE test centers for giving exams. The test centers can be selected at the time of enrollment.

- Secondly, the test center has a policy in which candidates are required to reach the exam center 30 minutes prior to the test time.

- Thirdly, an original Photo ID that can be a PAN card, Driver’s License, Passport, Employee ID, Voter’s ID card, or Student ID card, is required for verification on the exam day.

- Next, a backup sheet and rough sheet(s) will be provided to the candidates, and also they can bring the scientific calculator and a pen during the test.

Preparation Guide for Banking Sector Module (Intermediate)

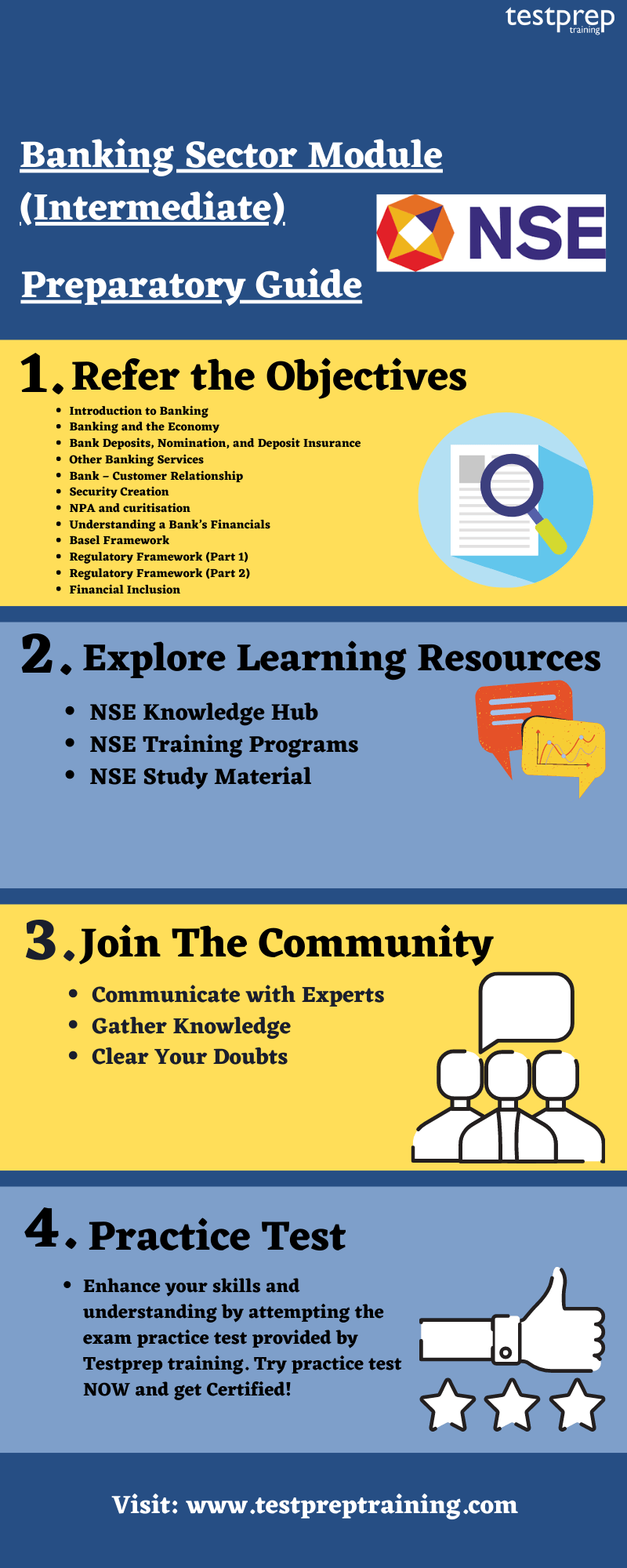

For the NSE Banking Sector Module (Intermediate) test, there are several materials available. All that is required of the applicants is to concentrate on picking the ideal resources based on their comfort level and degree of comprehension. This resource selection will impact how well they will pass their exam. Let’s have a look at a few of the options.

Visit the Official Website

Visting the NSE official website is an important step while preparing for the exam like Banking Sector Module (Intermediate). Also, the official website provides a lot of essential information and sources which is very helpful in preparing for the exam. Further, resources such as study guides, courses, sample papers, training programs, whitepapers, documentation, faqs, etc. The candidate can find all such important things on the official page.

Refer the Exam Guide

Before starting your preparation, it is very important to known the course structure and exam guide. For the examination, you should visit the official website to get the course outline and exam guide for the above examination. Below are the objectives of the Banking Sector Module (Intermediate) examination:

- Introduction to Banking

- Banking and the Economy

- Bank Deposits, Nomination, and Deposit Insurance

- Other Banking Services

- Bank – Customer Relationship

- Security Creation

- NPA and curitisation

- Understanding a Bank’s Financials

- Basel Framework

- Regulatory Framework (Part 1)

- Regulatory Framework (Part 2)

- Financial Inclusion

NSE Knowledge Hub

NSE gives access to an AI-First and Mobile-First ecosystem with personalized and community-based learning. This knowledge hub refers to a unique Artificial Intelligence (AI) powered learning platform that helps in financial learning as well as to assist the BFSI sector in enhancing skills for their employees. This also helps academic institutions in preparing advanced future-ready talent for the financial services industry. Further, NSE Knowledge Hub will help:

- Firstly, to be a part of a growing learning community.

- Secondly, in getting access to unlimited content from both global and premium resources.

- Also, in understanding and learning from experts in this field.

- Learning on the go through mobile.

NSE Study Material

NSE provides study material for its module exams that includes a workbook. This workbook can only be issued after making payment for the module. You can download by logging into your account from the E-Library option. However, NSE also offers candidates to buy these Workbooks for NCFM modules by sending a request letter with a demand draft of Rs. 500/- per module per workbook.

Join a Study Group

Joining a group study or an online community will also be useful for the candidate. It will help them to do more hard work. Also, studying in the group will help them to stay connected with the other people who are on the same pathway as them. Also, the discussion of such study groups will benefit the students in their exams.

Practice Test

Practice tests are the one that ensures the candidate about their preparation. The practice test will help the candidates to acknowledge their weak areas so that they can work on them. There are many practice tests available on the internet nowadays, so the candidate can choose which they want. The candidate can start preparing for Banking Sector Module (Intermediate) Now!