Accredited Financial Examiner

According to the Society of Financial Examiners (SFE), a candidate must first be an Accredited Financial Examiner before becoming a Certified Financial Examiner (AFE). The Accredited Financial Examiner is a professional who works in the discipline of business administration, primarily accounting, but may also work in economics, finance, or another related sector.

A career as a Certified Financial Examiner (CFE) may provide you with the opportunity to learn about financial markets while also assisting businesses in understanding the regulatory problems surrounding certain transactions. Continue reading to learn more about the education and certification requirements for this position, as well as the job forecast.

What You Should Know about the Accredited Financial Examiner?

A financial examiner is a third-party professional who examines financial data to ensure that institutions are following all rules and regulations. Financial examiners typically work for the federal and state governments, ensuring that financial and securities transactions between companies are legitimate. Many financial examiners, on the other hand, work for brokerage firms and act as third-party mediators, checking for any violations of federal or state standards in transactions.

| Degrees | Bachelor’s degree in accounting |

| Certification | Certifications available through the Society of Financial Examiners include the Accredited Financial Examiner, Certified Financial Examiner, and Automated Examination Specialist designations |

| Salary (2017)* | $81,690 per year (Median salary for financial examiners) |

What is the procedure for certification?

According to the Society of Financial Examiners (SFE), you must first be an Accredited Financial Examiner before becoming a Certified Financial Examiner (AFE). To become an Accredited Financial Examiner, you must meet five requirements. The first need is that you have a bachelor’s degree in accounting or a bachelor’s degree in finance with business law, auditing, basic accounting, and intermediate accounting courses. The second criterion is to pass all four AFE tests, which include the following topics:

- Life and health insurance

- Property and liability insurance

- Accounting property insurance

- Accounting life insurance

The third and fourth requirements, respectively, are two years of insurance industry work experience and a solid personal or professional standing with the SFE. Finally, a comprehensive application is required by the Society of Financial Examiners.

If you have finished or are working on your Accredited Financial Examiner credential, you can take the three required certification examinations to become a CFE, which involve management and examiner procedures, analysis and evaluation methodologies, and reinsurance policies. You must work an additional year in the insurance sector for a total of three years and show that you have three-semester credits in a management class on your college transcript in order to be certified.

Exam Overview

For AFE tests, a passing score of 70% is required, whereas, for CFE tests, a score of 74% is required. The following are the testing fees: Fees for members: $200 to take a test for the first time; $150 to retake an exam. Non-member fees are $275 for the first exam and $210 for retakes.

For more information, click on Accredited Financial Examiner FAQ.

What are the prospects for a Career?

Financial examiners investigate all relevant financial data between clients or firms, either as part of a study team or separately. Often, especially if you work for the government, you or your group has the authority or requires further permission to demand more financial information from businesses. In order for you or your examiner team to review the transaction in question, legal and regulatory facts must be followed and understood properly. If you calculate or determine that there is insufficient information or that the financial figures do not add up, you have the authority to make or break big financial arrangements between corporations.

Preparatory Guide for Accredited Financial Examiner

You must have all of the exam preparation resources, including the study guide, in order to pass the exam. This may appear to be an easy activity, but passing the exam will require complete exam details and proper learning tools. Let’s go over them one by one to start our preparation.

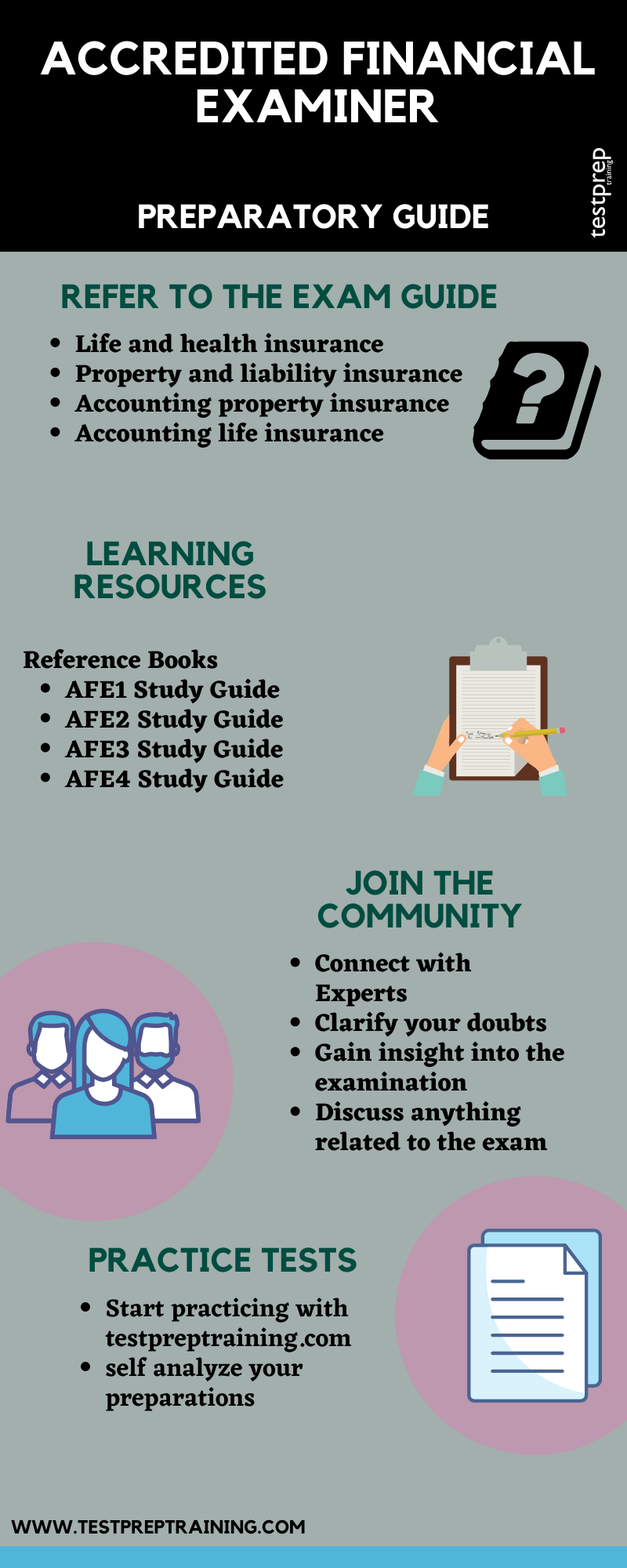

Refer the Exam Guide

Obtaining a copy of the Accredited Financial Examiner exam guide is the first step. The exam course is accurately described in this exam guide. To obtain a complete grasp of your subject, study the test guide. Make sure you understand the topics of the course as well. You must have a thorough understanding of the exam specifics before you begin your exam preparations, which is why the official guide is required.

- Life and health insurance

- Property and liability insurance

- Accounting property insurance

- Accounting life insurance

Books and Guides

When it comes to studying for any exam, the most popular resource has always been books. They are a wonderful resource for learning everything there is to know about the subject. There are several publications available on the market to help you prepare for the Accredited Financial Examiner exam. Choose the books that best suit you from the vast variety. There are certain guides by the official offered by SOFE. There are also, SOFE study guides available:

Join a Study Group

Joining a study group is an excellent way to thoroughly immerse yourself in the certification exam you’re taking. Furthermore, these organizations will assist you in staying current with any changes or exam updates. These groups also include both amateurs and pros. Without fear of being judged, you are allowed to ask any test-related question or discuss the exam. You can also start a discussion about any exam-related issue or question here. If you do so, you will obtain the best possible response to your query.

Self Evaluate with Practice Tests

As we all know, practice makes perfect. Your study guide should include practice tests. It aids in the evaluation of your preparations and the identification of your weaker areas. Success is practically assured if these areas are strengthened. Additionally, take as many tests as you can. The more you practice, the better you’ll get at it. Start practicing as soon as possible!