NISM Series III-B Issuers Compliance

The National Institute of Securities Markets is a federal association which was founded in 2006 by the Securities and Exchange Board of India, the administrator of the securities exchanges in India. NISM offers various certification courses to elevate your career and to make you achieve proficiency in your field. The NISM Series III-B Issuers Compliance Exam will help you gain expertise in the various compliances which require to be adhered to by associated persons who are working as compliance officers.

Exam Objectives

The NISM Series III-B Issuers Compliance Exam will demonstrate the candidates’ skills in the following fields –

- Understanding the roles and responsibilities of a Compliance officer

- Understanding the various avenues for raising funds from the Indian and the global market. Also, knowing the various compliance requirements

- Knowledge of the laws and regulations that require to be adhered to by any public company with respect to the issues, corporate actions, and the day to day compliance requirements

- Knowledge of the various penalties for non-compliance with regulations and requirements which are specified in various regulations

Exam Overview

The NISM Series-III-B Issuers Compliance Certification Examination is an entry-level exam in the capital markets. NISM Certifications and courses are designed and created by the institutional action of the Securities and Exchange Board of India (SEBI). Attaining these NISM Certifications are obligatory for the members working in the capital markets. Moreover, the Investors, students, and the general public are allowed to take these NISM Certification exams to gain knowledge and enhance employability.

The NISM Series III-B Issuers Compliance certification works to consider the gap between the demand and the supply of professionals and experts for the securities market. The ones aspiring to build a professional career as a stockbroker, or as the operator of a stockbroking firm, requires to get accredited by NISM compulsorily.

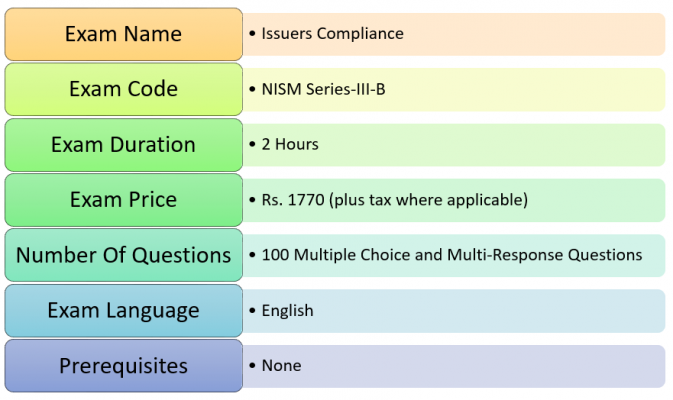

Exam Details

The NISM Series III-B Issuers Compliance Exam comprises of a total of 100 questions of 1 mark each. The duration of the exam is 2 hours, with a passing score of 60%. Most importantly, this exam will have negative scoring of 25% of the marks allotted per question. Also all NISM Series-III-B: Issuers Compliance Exam Questions are available in English language only.

Passing Certification will be assigned only to those candidates who have updated their Income Tax Permanent Account Number (PAN) in their enrollment details. The certification will be valid for a period of 3 years.

For More Details See – NISM Series-III-B: Issuers Compliance FAQ

NISM Series-III-B: Issuers Compliance Course Outline

Introduction to Indian Capital Market

- 1.1 Understand the Capital Market Structure in India and the Role of Capital Market

- 1.2 Discuss the Regulatory Framework in India

Capital Market Regulations

- 2.1 SEBI Act, 1992

- 2.2 Companies Act 1956,

- 2.3 Securities Contracts (Regulation) Act, 1956

- 2.4 Listing Agreement

- 2.5 Foreign Exchange Management Act, 1999 (FEMA)

- 2.6 Prevention of Money Laundering Act, 2002 (PMLA)

- 2.7 The Competition Act, 2002

- 2.8 SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 (SEBI(ICDR))

- 2.9 SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

- 2.10 SEBI (Buy-Back of Securities) Regulations, 1998

- 2.11 SEBI (Prohibition of Insider Trading) Regulations, 1992

- 2.12 SEBI (Intermediaries) Regulations, 2008

- 2.13 SEBI (Delisting of Equity Shares), Regulations, 2009

- 2.14 SEBI (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999

- 2.15 Companies (Issue of Indian Depository Receipts) Rules, 2004 (IDR Rules)

- 2.16 SEBI (Issue of Sweat Equity) Regulations, 2002

Compliance Officer

- 3.1 Appointment of Compliance Officer

- 3.2 Role of Compliance Officer

- 3.3 Responsibilities of a Compliance Officer

- 3.4 Reporting requirements

Raising Capital From the Market

- 4.1 Why raise money from the market

- 4.2 Evolution of Public Issues

- 4.3 Raising money

Role of Compliance Officer in IPO

- 5.1 Planning an IPO

- 5.2 General Obligations during Public Issue

- 5.3 Marketing the Issue

- 5.4 Application Supported by Blocked Amount (ASBA)

- 5.5 Allotment of Shares

- 5.6 Listing with Stock Exchanges

- 5.7 Post Issue Compliances

Role of Compliance Officer in Other Public Issues

- 6.1 Further Public Offer

- 6.2 Rights Issue

- 6.3 Bonus Issue

- 6.4 Employee Stock Option Plan (ESOP)

- 6.5 Sweat Equity

- 6.6 Private Placement

- 6.7 Indian Depository Receipts (IDR)

Raising Money From Foreign Market

- 7.1 American Depository Receipt (ADR) / Global Depository Receipt (GDR)

- 7.2 Foreign Currency Convertible Bonds (FCCB)

Corporate Actions

- 8.1 Related laws and process

Ongoing Compliance Requirements

- 9.1 Reports to be submitted as per Listing Agreements

- 9.2 Compliances under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

- 9.3 Compliances under the SEBI ( Prohibition of Insider Trading) Regulations, 1992

- 9.4 Appellate Tribunal

- 9.5 Scores system for investor grievance

Additional Read: SAT Cases

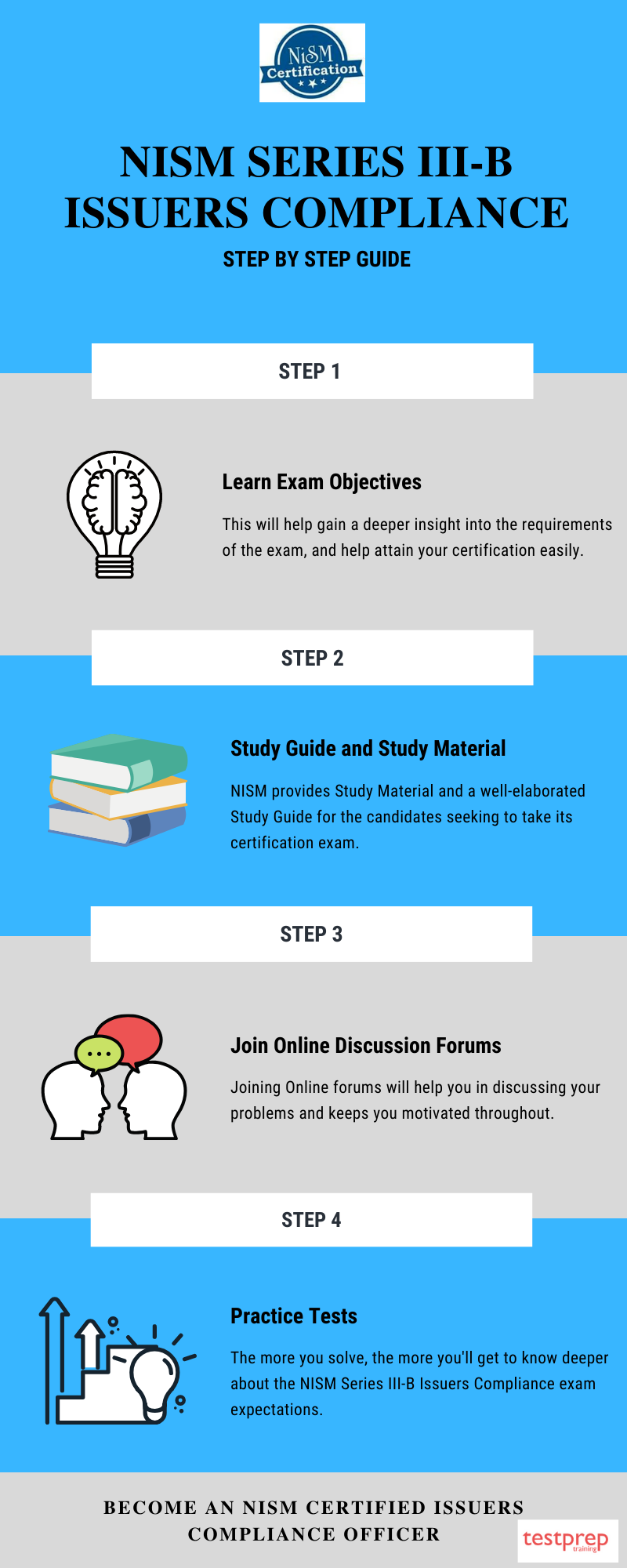

Preparation Guide For NISM Series III-B Issuers Compliance Exam

Learn Exam Objectives

Understanding the objectives of the exam, and thoroughly analyzing the various domains of the exam is the first step to prepare for the exam. This will help gain a deeper insight into the requirements of the exam, and help attain your certification easily.

The Objectives of the NISM Series III-B Issuers Compliance Exam are –

- Introduction to Indian Capital Market

- Capital Market Regulations

- Compliance Officer

- Raising Capital from the market

- Role of Compliance Officer in IPO

- Role of Compliance Officer in other public Issues

- Raising money from the foreign market

- Corporate Actions

- Ongoing Compliance Requirements

Study Guide and Study Material

NISM provides a well-elaborated Study Guide for the candidates seeking to take its certification exam. It contains a detailed and informative elaboration of the exam objectives, helping you become familiar with the perspectives of the NISM certifications.

As far as the Study Material for the NISM Series III-B Issuers Compliance is concerned, NISM workbooks are available online through Taxmann Publications Private Ltd.

Join Online Discussion Forums

Joining Online forums will help you in discussing your problems with other people taking the same exam. In addition to this, you will be able to get insights into how your competitors are preparing for the exams. One thing which is an advantage for anything that comes online is the scope of people joining it. Offline discussions are restricted to a small number of people. But online platforms have a wider range. This will not only train you but will also let you know where you stand in the competition. This will in turn, keep you motivated throughout.

Start Practicing Now!

The advantages of solving practice tests cannot be undermined. The more you solve, the more you’ll get to know deeper about the NISM Series III-B Issuers Compliance exam expectations. This will not only make you familiar with the exam environment. But will also increase your confidence. Moreover, the chances of you committing mistakes are reduced with NISM Series-III-B: Issuers Compliance Sample Questions. As you will avoid repeating the mistakes that you did while solving the practice tests. Remember, Practice makes a man perfect. Boost your confidence with NISM Series-III-B: Issuers Compliance Practice Exams now!