Equity Derivatives: A Beginner’s Module

NSE Equity Derivatives: A Beginner’s Module is a training program designed for individuals who want to learn about the basics of equity derivatives trading in India. The module is offered by the National Stock Exchange of India (NSE) and covers topics such as futures, options, trading strategies, and risk management.

The program consists of online study material and an examination that can be taken online or at an NSE-approved test center. The duration of the course is 2 months, and the examination consists of 100 multiple-choice questions that must be completed within 2 hours.

The course is open to individuals with a basic understanding of the Indian stock market and is recommended for students, investors, traders, and financial professionals who want to gain knowledge of equity derivatives trading. The program covers the following topics:

- Introduction to derivatives: This section covers the basics of derivatives, including futures and options, and their uses in the stock market.

- Equity derivatives: This section covers the different types of equity derivatives available in the Indian market, including stock futures, index futures, stock options, and index options.

- Trading strategies: This section covers different trading strategies that can be used in the derivatives market, including hedging, speculation, and arbitrage.

- Risk management: This section covers the risks involved in derivatives trading and how to manage them effectively.

- Clearing and settlement: This section covers the clearing and settlement process for derivatives trades, including the role of clearing corporations and settlement cycles.

Upon successful completion of the program and passing the examination, participants will receive a certificate from NSE. The certificate is valid for three years and can be used as proof of knowledge and competency in equity derivatives trading.

Learning Objectives from Equity Derivatives

- Firstly, understand the concept of the derivative.

- Secondly, learn the types of derivative products and their application.

- Moreover, learn about the trading of derivatives on the stock exchanges.

Target Audience

The Equity Derivatives: A Beginners Module Exam is targeted towards the following mentioned audience:

- Firstly, Students

- Secondly, Teachers

- Thirdly, Employees of Brokers/Sub-brokers

- Fourthly, Individual Investors

- Also, Employees of BPOs/IT companies

- Lastly, Anybody having an interest in the derivatives market

Equity Derivatives Exam Details

Familiarising with the exam details is important before commencing on with your preparations. NCFM Equity Derivatives Beginners Module Exam Questions are in multiple-choice format. You get 120 minutes to complete the 60 questions of this exam. In addition, the passing score is 50%. Most significantly, since there are no negative marks, you can attempt all of the questions.

| Exam Name | Equity Derivatives: A Beginner’s Module |

| Vendor | NSE – National Stock Exchange of India Ltd. |

| Exam Level | Foundation |

| Certification Validity | 5 Years |

| Exam Language | English |

| Question Format | Multiple Choice Questions |

| Exam Duration | 120 minutes |

| Number of Questions | 60 |

| Passing Score | 50% |

| Negative Marking | No |

Exam Registration

Candidates can register online by accessing the link ‘Online Registration’ available under Education>Certifications>Online Register / Enroll.

Once registered, you will get a unique NCFM registration number along with a user id and password. Confirmation will be sent to the email id and mobile number entered during registration. Using the same, you can access your online NCFM account to make payment / enroll for test/update address/check study material status/view certificates, etc.

Frequently Asked Questions

CLICK HERE to move to the Frequently Asked Questions section.

NCFM Equity Derivatives Beginners Module Course Outline

1. Introduction, Definition and Applications of Derivatives

- Definition and origin of derivatives

- Definitions of forwards; futures; options

- Moneyless of an option

- Participants in the derivatives market and uses of derivatives.

2. Trading Futures and Options

- Pay-off of futures

- Theoretical model for future pricing

- Option prices.

3. Derivatives Trading on the Exchange

- Derivatives trading and settlement on NSE; using daily newspapers to track futures and options

- Accounting and taxation of derivatives.

Equity Derivatives Beginners Module Practice Exam Questions

1. What is an equity derivative?

a) A contract that derives its value from the performance of a particular stock or index

b) A security that represents ownership in a company

c) A type of bond that pays a fixed interest rate

d) A type of mutual fund that invests in stocks

2. What is a futures contract?

a) An agreement to buy or sell an underlying asset at a predetermined price and date in the future

b) An agreement to lend money at a fixed interest rate

c) An agreement to buy or sell a stock at the current market price

d) An agreement to buy or sell a stock at a price that is set at the end of the trading day

3. What is an options contract?

a) An agreement to buy or sell an underlying asset at a predetermined price and date in the future

b) An agreement to lend money at a fixed interest rate

c) An agreement to buy or sell a stock at the current market price

d) An agreement to buy or sell a stock at a price that is set at the end of the trading day

4. What is the difference between a call option and a put option?

a) A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset

b) A call option gives the buyer the right to sell the underlying asset, while a put option gives the buyer the right to buy the underlying asset

c) A call option gives the buyer the right to buy the underlying asset at the current market price, while a put option gives the buyer the right to sell the underlying asset at the current market price

d) A call option gives the buyer the right to sell the underlying asset at the current market price, while a put option gives the buyer the right to buy the underlying asset at the current market price

What is the maximum potential loss for a buyer of a futures contract?

a) Unlimited

b) Limited to the premium paid for the contract

c) Limited to the strike price of the contract

d) Limited to the margin paid for the contract

Answers:

1. (a) A contract that derives its value from the performance of a particular stock or index

2. (a) An agreement to buy or sell an underlying asset at a predetermined price and date in the future

3. (a) An agreement to buy or sell an underlying asset at a predetermined price and date in the future

4. (a) A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset

5. (a) Unlimited

More practice tests on Equity Derivatives: A Beginner’s Module, checkout Testprep Training..

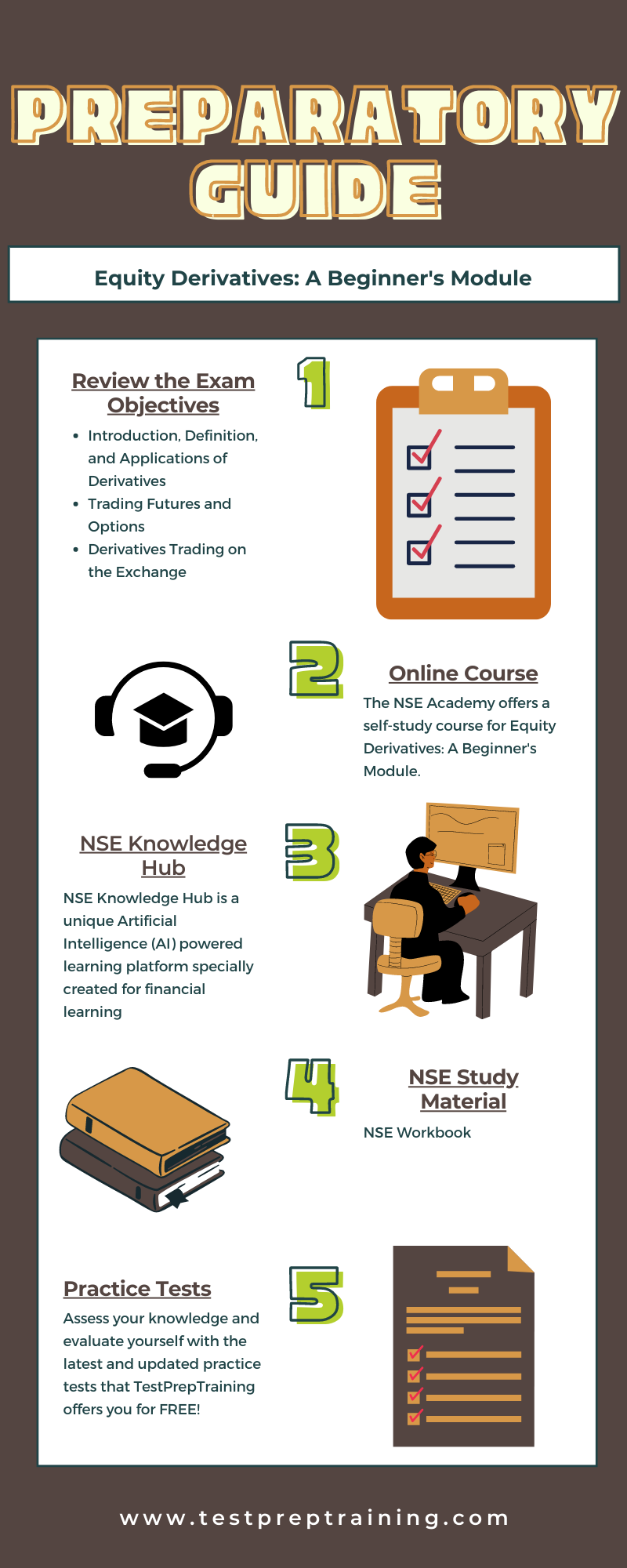

Preparatory Guide – Equity Derivatives

Before you get started, you must refer to the following NCFM Equity Derivatives Beginners Module Study Guide that mentions all the relevant and possible learning resources that are ideally required for the exam preparation.

1. Refer to Exam Objectives

For Equity Derivatives: A Beginner’s Module, NCFM provides the course outline. This course outline includes topics categorized into various sections and subsections, thus, helping candidates to start their preparation in a sequential way. For the test, the course outline includes:

- Firstly, Introduction, Definition, and Applications of Derivatives

- Secondly, Trading Futures and Options

- Thirdly, Derivatives Trading on the Exchange

2. Online Course

The NSE Academy offers the self-study course for Equity Derivatives: A Beginner’s Module. Enrolling in here can help you understand all the fundamentals and essential concepts. Furthermore, this will lead to help you prepare for the test.

3. NSE Knowledge Hub

NSE Knowledge Hub is an AI-First and Mobile-First ecosystem of personalized and community-based learning. This is a unique Artificial Intelligence (AI) powered learning platform specially created for financial learning and to assist the BFSI sector in enhancing skills for their employees and helping academic institutions in preparing future-ready talent skilled for the financial services industry.

- Firstly, become familiar with banking, insurance, and finance topics, discover content in various domains in finance

- Secondly, formal and informal learning through hours of curated content tailored to the individual’s areas of interests and goals

- Lastly, Up-Skill by enrolling in free or paid deep skilling pathways at a marketplace with well-known providers of courses, assessments, labs, and credentials

4. Equity Derivatives: A Beginners Module Study Material

NSE provides a workbook for its all certification exam that can be issued only after making payment for the module. This can be easily downloaded by logging into your account from the E-Library option. However, NSE also offers candidates to purchase the Workbooks for NCFM modules by sending a request letter. This has to be done along with a demand draft of Rs. 500/- per module per workbook.

5. Practice Tests

Self-evaluation provides you with greater insight into your preparation. Before the actual certification test, indeed, it is highly recommended to give practice tests. Moreover, these NCFM Equity Derivatives Beginners Sample Questions will help you determine your skills and preparation, making you familiar with the exam pattern.

Assess your knowledge and evaluate yourself with the latest and updated NCFM Equity Derivatives Beginners Module Practice Tests that TestPrepTraining offers you for FREE!

Get ready and boost your preparation with TestPrep Training Tutorial on Equity Derivatives: A Beginner’s Module exam and practice tests.