NISM-Series-V-A: Mutual Fund Distributors

The NISM-Series-V-A: Mutual Fund Distributors Certification Examination seeks to create a common minimum knowledge benchmark for all persons involved in selling and distributing mutual funds including:

- Firstly, Individual Mutual Fund Distributors

- Secondly, Employees of organizations engaged in sales and distribution of Mutual Funds

- Thirdly, Employees of Asset Management Companies especially persons engaged in sales and distribution of Mutual Funds

The certification aims to enhance the quality of sales, distribution and related support services in the mutual fund industry.

Learning Objectives

On successful completion of the NISM Series-V-A Mutual Fund Distributors Certification, the candidate should:

- Firstly, know the basics of mutual funds, their role and structure, different kinds of mutual fund schemes, and their features

- Secondly, understand how mutual funds are distributed in the market-place, how schemes are to be evaluated, and how suitable products and services can be recommended to investors and prospective investors in the market.

- Thirdly, get oriented to the legalities, accounting, valuation, and taxation aspects underlying mutual funds and their distribution.

- Lastly, get acquainted with financial planning as an approach to investing in mutual funds, as an aid for mutual fund distributors to develop long-term relationships with their clients.

Target Audience

The following persons can take NISM-Series-V-A: Mutual Fund Distributors Certification Examination:

- Firstly, associated persons including distributors, agents, brokers, sub-brokers or called by any other name, employed or engaged or to be employed or engaged in the sale and/or distribution of mutual fund products.

- Secondly, interested students/professionals

- Lastly, any other individuals

Exam Details

Familiarising with the exam details is important before commencing on with your preparations. All NISM-Series-V-A Mutual Fund Distributors Exam Questions are in Multiple Choice Format. You get 120 minutes to complete the 100 questions of this exam. Also the certification is valid for 3 years. Moreover, the NISM Series V A Mutual Fund Distributors Certification Exam will cost you ₹1500/-

| Exam Name | NISM-Series-V-A: Mutual Fund Distributors |

| Certification Validity | 3 Years |

| Exam Duration | 120 Minutes (2 Hours) |

| Exam Format | MCQ’s |

| Total Number of Questions | 100 |

| Maximum Marks | 100 |

| Passing Marks | 50% |

| Negative Marking | No |

| Exam Fees | ₹1500/- |

How to Register & Enroll for the exam?

For registrations, candidates may visit https://certifications.nism.ac.in/nismaol/.

After successful registration, candidates may select a test center, date, and time slot of their choice on the Test Administrator website.

Visit HERE to refer to the registration guidelines.

Re-Certification Policy

To renew your current certificate, you need to appear for NISM CPE for Mutual Fund Distributors or successfully pass the NISM Mutual Fund Distributors Certification Examination before the expiry of such certificate.

Frequently Asked Questions

Click HERE to find answers to the frequently asked questions for the NISM Series V A Mutual Fund Distributor Exam.

Course Outline

The Course Outline for NISM Series V A Mutual Fund Distributor Exam:

The NISM-Series-V-A Mutual Fund Distributors Certification Examination Syllabus covers following domains:

I. Investment Landscape

- Understand the parameters of the Indian Economy Describe about Investors and their Financial Goals

- Understand Savings and Investment

- Discuss Different Asset Classes

- Understand the classification of Investment Risks

- Explain Risk Measure and Management Strategies

- Understand Behavioral Biases in Investment Decision Making

- Understand Risk Profiling

- Explain the Asset Allocation

- Comparison between the two approaches – Do-it-yourself and Taking Professional Help

II. Concept & Role of a Mutual Fund

- Explain the concept of mutual fund

- Understand the classifications of mutual funds

- Describe the Growth of the mutual fund industry in India

III. Legal Structure of Mutual Funds in India

- Describe the structure of mutual funds in India

- Understand the key constituents of a Mutual Funds

- Understand the organizational structure of Asset Management Company

- Moreover, understand the role and support functions of service providers of mutual funds

- Explain the Role and Function of AMFI

IV. Legal and Regulatory Framework

- Describe the role of regulators in India

- Discuss the role of the Securities and Exchange Board of India

- Know the Due Diligence process followed by AMCs for distributors of mutual funds

- Explain Investor Grievance and Redressal standards (Explain about SCORES)

- Understand AMFI Code of conduct for Intermediaries

V. Scheme Related Information

- Understanding the Mandatory Documents and their purpose, objective, and significance

- Explain the Non-Mandatory Disclosures

VI. Fund Distribution and Channel Management Practices

- Explain the role and importance of mutual fund distributors

- Understand the classification of mutual fund distributors

- Explain the modes of distribution

- Understand the Pre-requisites to become a Distributor of the Mutual Fund

- Explain Revenue for a mutual fund distributor

- Know the Commission Disclosure mandated by SEBI

- Explain the Due Diligence Process by AMCs for Distributors of Mutual Funds

- Discuss Nomination facilities to Agents / Distributors and Payment of Commission to Nominee

- Explain about a change of distributor

VII. Net Asset Value, Total Expense Ratio and Pricing of Units

- Discuss the Fair Valuation Principles

- Compute net assets of a mutual fund scheme and NAV

- Explain about Dividends & Distributable Reserves

- Know about the Concept of Entry and Exit Load and its impact on NAV

- Know about the Key Accounting and Reporting Requirements applicable to mutual funds

- Also, know about the NAV, Total expense ratio, and pricing of units for the Segregated Portfolio

VIII. Taxation

- Firstly, understand the Applicability of various taxes in respect of mutual funds

- Secondly, understand Capital gains, Capital gains (Long term & Short term) tax, and Indexation.

- Thirdly, understand the Dividend Income and Dividend Income tax

- Fourthly, understand the difference between dividend distribution tax and capital gains tax

- Understand the basics of Setting off Gains and Losses under the Income Tax Act

- Furthermore, understand about Securities Transaction Tax

- Understand about Tax benefit under Section 80C of the Income Tax Act for investment pertaining to mutual funds

- Also, understand about Tax Deducted at Source (TDS) in mutual funds

- Lastly, understand the Applicability of GST in mutual funds

IX. Investor Services

- Describe the NFO Process

- Explain about the New Fund Offer Price /On-going price for subscription

- Discuss Different types of investment plans and options

- Explain how the mutual fund units are allotted to the investor

- Describe the content and periodicity of the Statement of Accounts for investments

- Describe different types of Mutual Fund Investors

- Explain how to fill in the application form for mutual funds

- Describe the financial transactions with mutual funds (Purchase, Redemption, and Switches)

- Explain Cut-off time and Time Stamping

- Describe the KYC requirement for mutual fund investors

- Explain the different types of systematic transactions

- Explain operational aspects of systematic transactions

- Also, explain Non – Financial Transactions in Mutual Funds

- Discuss the change in Status of Special Investor Categories

- Explain Investor Transactions – turnaround times

X. Risk, Return and Performance of funds

- Understand the General and Specific Risk Factors

- Explain the Factors that affect mutual fund performance

- Describe Drivers of Returns and Risk in mutual fund Scheme

- Understand the Measures of Returns

- Know about the SEBI norms regarding the representation of returns by mutual funds in India

- Explain risks in fund investing with a focus on investors

- Understand the Measures of Risk

- Explain certain provisions with respect to Credit risk

XI. Mutual Fund Scheme Performance

- Explain the concept of Benchmarks

- Compare Price Return Index and Total Return Index

- Identify the Basis of choosing an appropriate performance benchmark

- Describe the use of market benchmarks to evaluate Equity Fund Performance

- Describe the use of market benchmarks to evaluate Debt Fund Performance

- Also, describe the use of market benchmarks to evaluate Other Schemes

- Explain Quantitative Measures of Fund Manager Performance

- Define Tracking Error

- Understand the different Sources for disclosure of scheme performance (Scheme documents, AMFI and AMC website, and Fund Fact Sheet)

XII. Mutual Fund Scheme Selection

- Explain Scheme Selection based on Investor needs, preferences, and risk profile

- Explain Risk Levels in mutual fund schemes

- Furthermore, explain Scheme Selection based on the investment strategy of mutual funds

- Explain Selection of Mutual Fund scheme offered by different AMCs or within the scheme category

- Know about selecting options in mutual fund schemes

- Know about Do’s and Don’ts while selecting mutual fund schemes

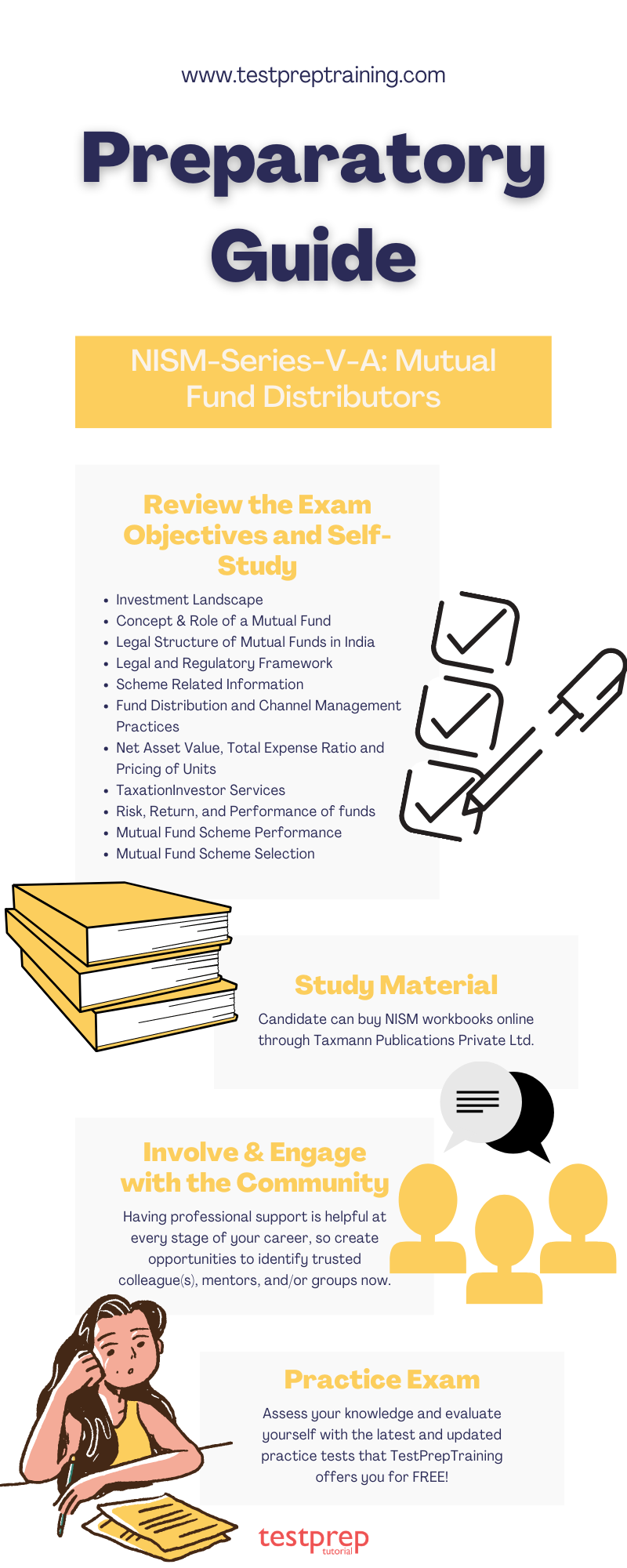

Preparatory Guide

Before you get started, you must refer to the following NISM – Series V-A Mutual Fund Distribution Examination preparatory guide that mentions all the relevant and possible learning resources that are ideally required for the exam preparation.

Review the Exam Objectives and Self-Study

Analyzing the curriculum will let you align yourself more deeply with the chief objectives of the exam. Moreover, this will enable you to gain the required command to earn your desired certification.

- Firstly, Investment Landscape

- Secondly, Concept & Role of a Mutual Fund

- Thirdly, Legal Structure of Mutual Funds in India

- Fourthly, Legal and Regulatory Framework

- Scheme Related Information

- Also, Fund Distribution and Channel Management Practices

- Net Asset Value, Total Expense Ratio and Pricing of Units

- Furthermore, Taxation

- Investor Services

- Moreover, Risk, Return, and Performance of funds

- Mutual Fund Scheme Performance

- Lastly, Mutual Fund Scheme Selection

NISM-Series-V-A Mutual Fund Distributor Study Material

Candidate can buy NISM workbooks online through Taxmann Publications Private Ltd. Visit https://www.taxmann.com/bookstore/nism-iibf-books.aspx to place your orders for NISM workbooks. The NISM-Series-V-A Mutual Fund Distributors Books are an important ingredient in your preparations.

If you prefer to order by phone, please call your nearest store directly to place your order.

Involve & Engage with the Community

Get involved and engaged with a community! This might include joining or volunteering with your local, regional, or national professional associations and groups focused in your area(s) of interest. You will likely learn a lot and have an opportunity to contribute.

Having professional support is helpful at every stage of your career, so create opportunities to identify trusted colleague(s), mentors, and/or groups now.

Practice Exam

Self-evaluation provides you with greater insight into your preparation. Before the actual certification test, indeed, it is highly recommended to give NISM Series V-A Mutual Fund Distributors Mock Tests. It will help you determine your skills and preparation, making you familiar with the exam pattern.

Assess your knowledge and evaluate yourself with the latest and updated NISM Series-V-A: Mutual Fund Distributors Practice Tests that TestPrepTraining offers you for FREE!