The CFE certification is a globally recognized professional qualification designed for individuals who specialize in preventing, detecting, and investigating fraud. To become a Certified Fraud Examiner, one must pass the CFE exam, which consists of four sections. The exam includes various subjects like stopping fraud, financial transactions and fraud plans, investigation, and the legal aspects of fraud.

In this blog, we will delve into the details of the CFE exam format, including the structure of the exam, the number of questions in each section, the time allotted for each section, and the scoring system. We will also discuss some tips and strategies to help you prepare for the exam and increase your chances of success. Whether you are already working in the anti-fraud profession or aspiring to become a Certified Fraud Examiner, this blog will provide you with the information you need to know about the CFE exam format. So, let’s get started!

What is the Certified Fraud Examiner Exam?

The Certified Fraud Examiner – CFE classification is issued by the Association of Certified Fraud Examiners (ACFE). This is the world’s largest anti-fraud organization, based in Austin, Texas. So, as a Certified Fraud Examiner (CFE) is a licensed certification accessible to fraud examiners. CFEs are subjected to periodic on going professional education qualifications (CPE) in the same manner as CPAs. Moreover, the ACFE recognizes the following areas as qualified professional experience:

- Firstly, Accounting and auditing

- Secondly, Criminology and sociology (sociology is acceptable only if it relates to fraud.)

- Thirdly, Fraud investigation

- Also, Loss prevention (experience as a security guard or equivalent is not acceptable)

- Then, Law relating to fraud

- Lastly, Other experiences can qualify but must be reviewed for applicability.

Glossary of Certified Fraud Examiner (CFE) Terminology

Here are some key terms and definitions commonly used in the field of Certified Fraud Examiner (CFE):

- Fraud: Purposeful trickery done to benefit oneself or to harm another person or organization.

- Corruption: Dishonest or illegal behavior by individuals or organizations, especially those in positions of power, often for personal gain.

- Asset misappropriation: Theft or misuse of an organization’s assets by employees or others with access to them.

- Bribery: Giving or receiving something valuable to sway someone in a powerful position.

- Kickback: Payment made to someone in exchange for a favor or a decision that benefits the payer.

- Money laundering: Hiding where illegally obtained money comes from by moving it through a series of complicated transactions.

- Forensic accounting: The application of accounting principles, investigative techniques, and legal concepts to analyze financial information for use in legal proceedings.

- Audit: Thoroughly checking financial records and transactions to make sure they follow accounting standards, laws, and regulations.

- Whistleblower: A person who tells authorities about wrongdoing or unethical actions happening in a company.

- Fraudulent financial reporting: Intentional misrepresentation of financial information in order to deceive investors, creditors, or other stakeholders.

- Red flags: Warning signs or indicators of potential fraud or other unethical behavior.

- Due diligence: Carefully examining a company, person, or opportunity before deciding or taking action.

- Ponzi scheme: A scam where profits for early investors come from money put in by new investors, not from actual earnings.

- Cybercrime: Criminal activity that involves a computer or the internet, such as hacking, identity theft, or phishing scams.

- Identity theft: Illegally using someone else’s personal information, like their name, Social Security number, or credit card details, to commit fraud or other crimes.

Exam preparation resources for Certified Fraud Examiner (CFE) exam

here are some official exam preparation resources for the Certified Fraud Examiner (CFE) exam:

- ACFE Exam Prep Course: The Association of Certified Fraud Examiners (ACFE) offers an exam preparation course that covers all four sections of the CFE exam. This course includes online study materials, practice questions, and a self-assessment exam. You can find more information and register for the course here: https://www.acfe.com/training-events/exam-prep-course/

- CFE Exam Review Course: The ACFE also offers an exam review course that is available in both live and self-study formats. This course provides a comprehensive review of the CFE exam content and includes practice questions, case studies, and other study materials. You can find more information and register for the course here: https://www.acfe.com/training-events/cfe-exam-review-course/

- CFE Exam Study Guide: The ACFE offers a study guide that provides an overview of the CFE exam content and includes practice questions and detailed explanations of the correct answers. You can purchase the study guide here: https://www.acfe.com/cfe-study-guide/

- CFE Exam Prep Toolkit: The ACFE offers a CFE exam prep toolkit that includes study materials, practice questions, and other resources to help you prepare for the exam. You can find more information and purchase the toolkit here: https://www.acfe.com/cfe-exam-prep-toolkit/

- ACFE Fraud Examiners Manual: The ACFE Fraud Examiners Manual is a comprehensive resource for fraud examiners that covers a wide range of topics related to fraud investigation and prevention. The manual is also a valuable resource for preparing for the CFE exam. You can purchase the manual here: https://www.acfe.com/fraud-examiners-manual/

Code of Ethics for CFE

The code of ethics declares that a Certified Fraud Examiner (CFE) must –

- Display commitment to professionalism and diligence in his/her duties.

- Not interest in any illegal or unethical behavior, or any action which constitutes a conflict of interest.

- Exhibiting the greatest level of honesty in the accomplishment of all professional assignments and will receive only assignments for which there is a reasonable expectation that the assignment will be finished with professional competence.

- Complying with lawful management of the courts and claim to matters truthfully and without preference or prejudice.

- Obtaining evidence or additional documentation to stabilize a reasonable basis for any opinion rendered.

- Not disclose any private information without proper authorization.

- Revealing all pertinent material elements identified during the course of an examination.

- Constantly strive to increase the proficiency and effectiveness of professional services delivered under their direction

CFE Exam Requirements

You must fulfil the following eligibility criteria to sit for the exam-

- First, those aiming for CFE certification need at least a bachelor’s degree or its equivalent from a higher education institution. They should also have two years of professional experience in fraud, where each year of work can replace a year of college.

- Additionally, they must have a minimum of two years of professional experience in a field connected to detecting or preventing fraud, either directly or indirectly, at the time of certification.

Prepare for CFE exam using the Study Guide!

CFE Exam Format

The exam format acts as a blueprint for the exam, Therefore you must have complete clarity about it.

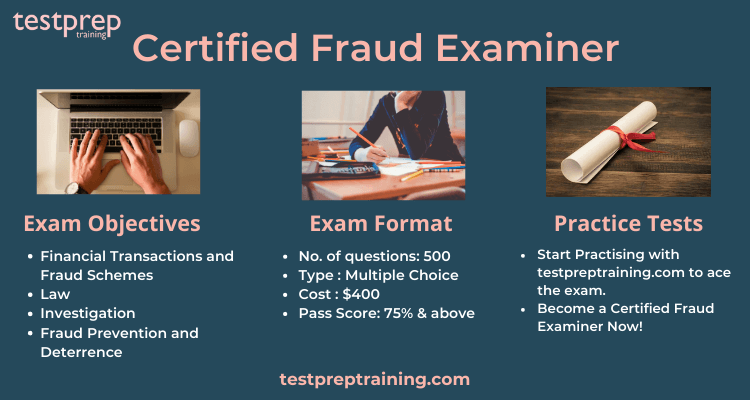

- Firstly, The Certified Fraud Examiner (CFE) exam can be easily taken online. And, the exam contains four sections.

- Secondly, the CFE exam is a closed-book and closed-notes exam that consists of 500 questions.

- Moreover, the CFE exam questions are in Multiple Choice and Multi-Response Format. As you answer the questions, use the method of elimination. Figure out and eliminate the wrong choice, and voila! you have the right answer.

- Further, the candidate can take the CFE Exam at any time convenient to them.

- The exam has a number of controls to guarantee honesty. This implies that no two exams are precisely the same as each exam is generated from a master database

- To pass, the candidate must score 75% marks. Therefore you need to maintain accuracy and speed.

- Also, The CFE exam cost is $400 USD.

System Requirements for the exam

As the Certified Fraud Examiner exam is administrated online, here are the technical requirements:

- To begin with, Windows 7 (Service Pack 1), Windows 8.1, Windows 10, Mac OS X 10.6 (Snow Leopard) or above

- Then, Screen resolution of 1280×1024 or greater

- Further, High-speed Internet connection (minimum 2Mbps upload/2Mbps download)

- Moreover, Ability to download web browser extension

- Also, Web camera, and Microphone

- Finally, Browser must be set to allow JavaScript, cookies, pop-ups, web camera access, and microphone access.

Exam Policy

You can retake the exam up to 3 times. CFE Exam retakes fees are $100 per section. You will receive an invoice with applicable exam retake fees with your exam results. Within 3-5 business days of paying the retake fee(s), your Retake Exam Key(s) will be sent to you by email.

Exam Scheduling

Candidates who wish to apply for the Certified Fraud Examiner (CFE) Exam must submit all of their documentation one month before they plan to take the CFE Exam. Candidates can schedule the exam at CFE official site.

Certification Validity

The Certified Fraud Examiner (CFE) certification is valid for two years.

Certified Fraud Examiner Course Outline

The Course Outline is really important for the exam because it’s like the exam’s syllabus. All the questions come from this list, so make sure you know the CFE sections well.

Financial Transactions and Fraud Schemes

- Firstly, It tests the candidate’s comprehension of the varieties of fraudulent financial activities acquired in accounting records.

- To claim Financial Transactions & Fraud Schemes, the candidate will be asked to illustrate knowledge of the subsequent concepts: fraud schemes, basic accounting and auditing theory, internal controls to prevent fraud, and additional accounting and auditing matters.

Law

- Further, It ensures the liberties with the various legal divisions of managing fraud examinations, including rules of evidence, criminal and civil law, rights of the challenged and accuser, and expert witness concerns.

Investigation

Fraud investigation involves-

- Firstly, Questions about taking statements

- Secondly, Interviewing

- Thirdly, Collecting information from public records

- Also, Investigating illicit transactions

- Moreover, Assessing deception and report writing

Fraud Prevention and Deterrence

- Additionally, It tests the candidate’s perception of why people engage in fraud and approaches to prevent it.

- Finally, Topics recounted in this section add white-collar crime, crime causation, occupational fraud, fraud risk assessment, fraud prevention, and the ACFE Code of Professional Ethics.

Exam Results | Certified Fraud Examiner

CFE Exam results are not immediate. Once all exam sections have been submitted for grading, you will receive your results by email in 3 to 5 business days.

Before anything else, preparation is the key to success. You must have access to the right resources to ace the exam. So lets have a look at your learning resources.

CFE Exam Preparatorion Resources: Your roadmap to success

Being consistent and determined are the main things you need to get your certification. However, it’s also crucial to prepare using reliable sources and stay on the right path. So firstly you should visit the Official Exam website and make sure you are on the same page as the vendor in respect to exam details and objectives.

The next step is to refer the outstanding reference guide i.e The Fraud Examiners Manual. Moreover, you can choose Instructor-Led Training is the best way for CFE exam preparation while developing strong understanding of the concepts. Instructors who are well versed and have excelled in this field are on board for teaching in the best possible way. The Association of Certified Fraud Examiners offers its own course to help you prepare better for the exam. And your next step is books. Books have been an age-old tradition and essential ingredient when it comes to preparing for any exam. The Certified Fraud Examiner A Complete Guide – by Gerardus Blokdyk is a great choice indeed.

Additionally, Online Tutorials enhance your knowledge and provide in depth understanding of the exam concepts. Moreover, Study Guides will help you stay consistent and determined. All these resources enrich your learning experience.

Experts Corner

The Certified Fraud Examiner credential makes your academic records shine. But you must be familiar with the exam details before the final race. You should be thorough with the exam format. Finally, all you need is practice. Practice tests are the most important as well as helping tools to prepare for the exam. CFE exam practice tests help you find out your core strengths and iron out your weaknesses. Strengthening these weaknesses improvises your preparations and expands your knowledge. Therefore, after preparation, we suggest you to try a hands-on practice test. Moreover, attempting Multiple Practice Tests helps in boosting your confidence. Start using CFE Exam Sample Questions for Practice Now!.